Did You Know You May Defer a Portion or All of Your Homestead Property Taxes?

The Miami Dade County Office of the Tax Collector, under the leadership of Tax Collector Dariel Fernandez, is committed to helping residents save money where they qualify and need it most—especially our elderly community.

The Homestead Tax Deferral Program allows eligible homeowners to postpone paying a portion, or in some cases all, of their property taxes until a later time. This program is designed to provide relief for residents on fixed or limited incomes who may find it difficult to pay the full amount of property taxes each year.

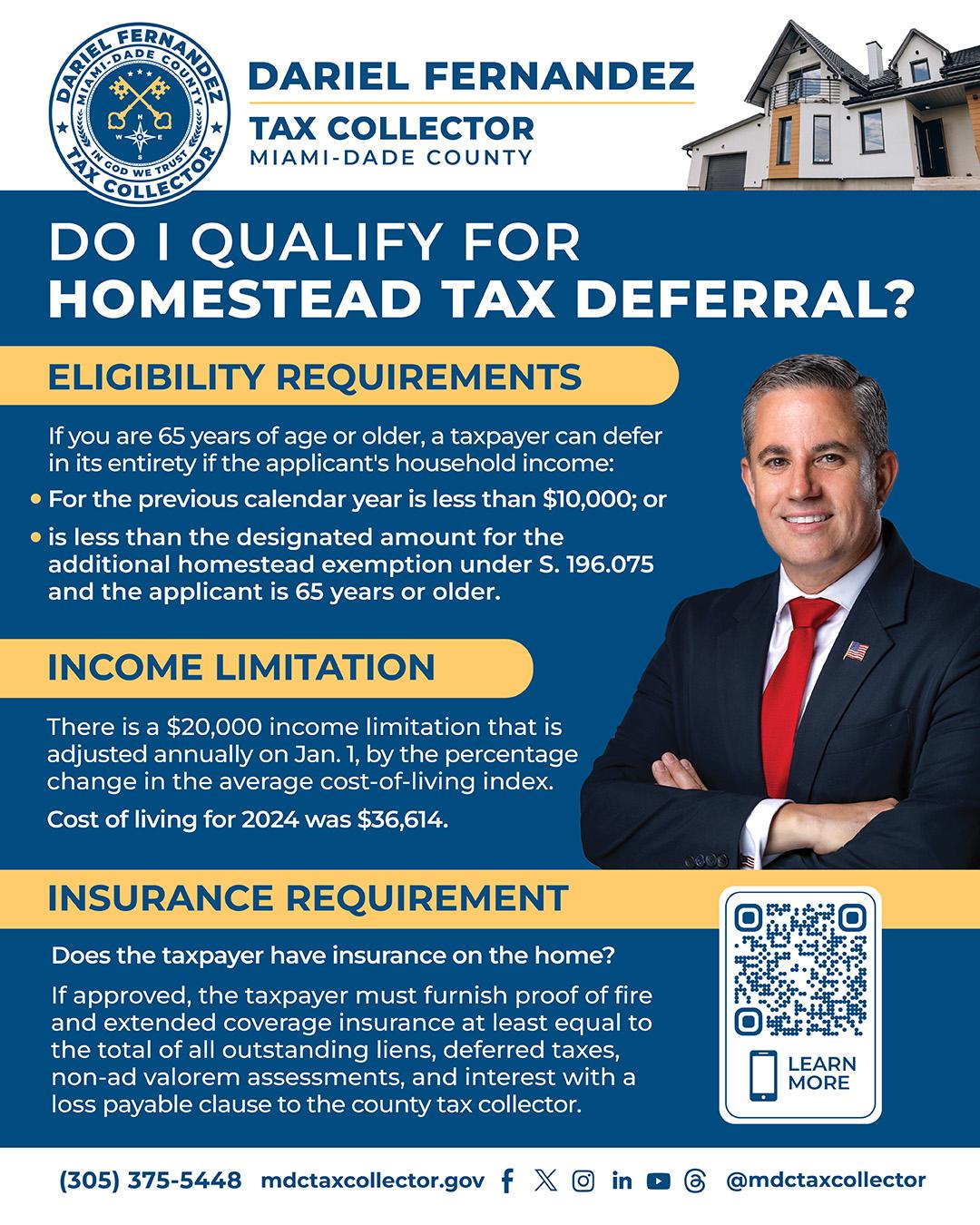

To qualify, you must meet certain requirements, including:

- Being approved for the Homestead Exemption.

- Meeting household income limits established by state law.

- Maintaining fire and extended coverage insurance on your home with the Tax Collector listed as a loss payee.

Deferred taxes do not go away, but they are postponed and become a lien on the property. They will eventually need to be repaid, such as when the property is sold or no longer qualifies for the exemption. However, this program provides valuable breathing room to those who need it most.

“Our mission is to put people first,” said Miami Dade County Tax Collector Dariel Fernandez. “For many seniors and families, deferring taxes can make a real difference in their ability to stay in their homes and manage expenses. We are here to guide residents through the process and ensure they have access to every opportunity to save.”

If you would like to learn more about eligibility, income limits, and how to apply, please visit: https://mdctaxcollector.gov/homestead-tax-deferral